Best AI investing tools for beginners sound exciting until you actually try to choose one. Suddenly it’s AI this, algorithm that, and every app promises “smarter returns.” If you’re feeling overwhelmed, you’re not alone. A 2025 Morgan Stanley survey found that while over 60% of new investors are curious about AI investing tools, a staggering 73% admit they don’t have the basic knowledge to choose one safely.

That’s exactly why this guide exists. Instead of confusing Wall Street jargon, we’ve tested, researched, and broken down the 7 best AI investing tools for beginners in 2026 explained like a friend would. You’ll learn what each tool actually does, who it’s truly for, and the hidden risks most reviews conveniently ignore. By the end, you’ll know exactly where to start and where not to.

Part 1: First, let’s simplify: What are the best AI Investing Tools for beginners, really?

Think of AI tools not as robot bosses, but as super-smart assistants. Their main job is to handle the boring, data-heavy work you don’t have time for.

The AI investing revolution isn’t coming; it’s already here and more accessible than ever. For beginners, this is great news, and the data proves it.

- Information Overload, Solved: Markets generate millions of data points daily. As Marcus Thiel, a former quant trader, notes, “Beginners used to drown in charts. Now, AI screeners can act as a lifeguard, pointing you to the 2-3 signals that actually matter from the noise of 200.”

- The Behavioral Boost: The biggest enemy for beginners isn’t a bad trade; it’s panic. Dr. Sarah Chen, a behavioral economist at Stanford, explains: “Our research shows tools like robo advisors act as a ‘commitment device.’ They automate the boring, disciplined tasks, reducing the ‘itch’ to make emotional, costly mistakes by nearly 40%.”

They come in a few main types, each with a different personality:

| Type of Tool | Think of It As… | Best For The Beginner Who… | Key Thing to Remember |

|---|---|---|---|

| Robo-Advisors | Your Automatic Pilot. | …wants to “set it and forget it.” Wants steady, long-term growth without checking charts daily. | It’s for building wealth slowly. Don’t expect get-rich-quick schemes. |

| AI Stock Screeners | Your Super-Fast Research Assistant. | …is curious, likes to learn, and wants help finding potential ideas in the stock market. | It gives you ideas, not orders. You still need to make the final decision. |

| AI-Powered Apps | Your Supportive Coach. | …is nervous to start. Wants to begin with tiny amounts of money and learn along the way. | It’s great for building the habit of investing with low pressure. |

The Reality Check: A Simple Fee Comparison (2026)

Before you start, this simple chart shows you where your money will actually go. Remember: “Minimum Deposit” lets you begin, but “True Cost” is what impacts your returns as your balance grows.

| Tool Name | Minimum to Start | How They Charge | The Real Cost (For You) |

|---|---|---|---|

| Acorns | $5 | $3 per month | Expensive for small balances. A $500 portfolio = 7.2% annual fee! |

| Betterment | $0 | 0.25% per year | Fair for all sizes. A $1,000 portfolio = $2.50 per year. |

| Wealthfront | $500 | 0.25% per year | Similar to Betterment, but with a higher starting point. |

| M1 Finance | $100 | $0 (Basic Plan) | Truly free for investing and creating pies. |

| Ally Invest | $0 | $0 for stock trades | Trading is free. Managed portfolios cost 0.30% per year. |

| TrendSpider | $0 (Trial) | ~$33 per month | Pricy, but for pros. The free trial is plenty for beginners. |

| Curvo | €100 | 0.55% per year | Slightly above average in Europe, but you pay for compliance & simplicity. |

💡 Beginner Insight: Only use Acorns if your balance will quickly grow above $1,000, otherwise, the flat fee will eat your returns.

Part 2: The 7 Best AI Investing Tools for Beginners in 2026

We evaluated dozens of platforms based on ease of use, cost, safety, and real value for someone just starting out. Here are our top picks.

1. Betterment (Best “Set and Forget” Robo-Advisor)

- “I want to invest for my future, but I don’t know how to start. Choosing stocks is scary, and I don’t have time to manage everything. I’m worried I’ll make an expensive emotional mistake.”

Think of It As: Your personal automatic pilot for long-term goals like retirement. You set the destination, and it handles the navigation, weather adjustments, and fuel efficiency without you touching the controls.

How It Actually Helps You (The Real-World Benefit):

- Eliminates the “Where Do I Put My Money?” Stress: You answer a few simple questions about your goal and risk tolerance. Betterment then builds and manages a globally diversified portfolio of ETFs for you. You don’t need to know what an ETF is.

- Prevents Your Worst Enemy (You): Its core job is to stop you from making emotional decisions. When the market drops and you feel panic, Betterment is programmed to do the counterintuitive smart thing, often automatically buying more at lower prices through a process called rebalancing.

- Saves You Money on “Hidden” Taxes: It runs a background feature called Tax-Loss Harvesting. In simple terms, it finds small, legal ways to offset your investment taxes, putting more money back into your pocket, something nearly impossible for a beginner to do manually.

What You’re Giving Up (The Honest Trade-Off):

You are trading control for simplicity and discipline. This is not a platform for stock picking, day trading, or following hot tips. If you dream of finding the next big thing, this will feel restrictive. If you dream of building wealth steadily without the daily stress, this is liberating.

Expert Insight! Dr. Sarah Chen, Behavioral Economist:

“Tools like Betterment reframe success. For a beginner, outperforming your own impulsive behavior is a greater victory than outperforming the market. These platforms are a commitment device that protects you from your worst financial instincts.”

Final Word for Beginners:

Choose Betterment if your top priority is to start investing correctly today and remove doubt, fear, and complexity from the process. It’s the tool that works quietly in the background while you focus on your life.

2. Wealthfront (For the Beginner Who Loves a Clear, Visual Roadmap)

“I know I should invest, but it all feels abstract. How do my choices today actually translate into buying a house in 5 years or retiring comfortably? I need to see the plan, or I won’t stay motivated.”

Think of It As: Your financial GPS with a live progress tracker. It doesn’t just give you a portfolio; it shows you a vivid, interactive map of how each dollar gets you closer to your life goals.

How It Actually Helps You (The Real-World Benefit):

- Turns Anxiety into Actionable Plans: Its standout feature, the Path™ planning tool, asks about your life (income, savings rate, goals). It then generates stunning, simple graphs that answer your biggest questions: “Am I on track?” “What if I save $100 more per month?“ It turns overwhelming uncertainty into a clear, adjustable roadmap.

- Makes Investing Feel Personal & Purposeful: Instead of just watching a number go up and down, you see your “Home Down Payment” or “Dream Vacation” fund growing. This psychological link is powerful it transforms investing from a chore into a direct step towards your dreams.

- Automates Advanced Strategies (That You’d Never Do Manually): Like Betterment, it offers automated portfolio management, rebalancing, and Tax-Loss Harvesting. For beginners, this means you’re getting sophisticated, tax-efficient investment management on autopilot from day one.

What You’re Giving Up (The Honest Trade Off):

The trade-off is primarily the cost of entry. Wealthfront has a slightly higher minimum deposit (usually $500) compared to some competitors that start at $0 or $100. You’re paying for a premium in planning sophistication and user experience.

Data Point Proof It Works:

According to Wealthfront’s 2025 client survey, users who actively used the Path™ planning tools were 25% more likely to increase their monthly contributions within 6 months. This tool doesn’t just inform it inspires positive action.

Final Word for Beginners:

Choose Wealthfront if you are a visual learner or a goal-oriented planner who needs to see the “why” behind your investments. If a beautiful, clear roadmap will keep you engaged and committed, this tool is worth the slightly higher starting point. It’s for the beginner who wants to be an informed, confident captain of their financial future, with a top-tier co-pilot handling the technical navigation.

3. M1 Finance (For the Beginner Who Wants to Learn by Doing)

“I don’t just want to set and forget. I’m curious! I want to understand what I own and why, and maybe one day pick my own investments. But starting from zero is too intimidating.”

Think of It As: Your investment training ground with training wheels. It starts you on a safe, pre-built bike path (automated portfolios), but the moment you feel steady, it lets you design your own route, all while keeping you balanced.

How It Actually Helps You (The Real-World Benefit):

- The Perfect “Try Before You Commit” Model: You can start with an Expert Pie, a pre-built, diversified portfolio crafted by professionals. You get the safety and automation of a robo-advisor. This lets you learn the basics (how dividends work, what rebalancing looks like) without the pressure of choosing stocks.

- Makes Building a Portfolio Feel Like a Simple Recipe: When you’re ready, you can create your own “Pie.” The interface lets you search for stocks or ETFs (like Apple or an S&P 500 fund) and assign them a “slice” (a percentage of your portfolio). M1’s automation then ensures your money is always invested according to that recipe, buying more of what’s underweight.

- Teaches Key Concepts Visually: The “Pie” metaphor and dashboard make abstract concepts like asset allocation, diversification, and fractional share investing instantly understandable. You see your portfolio as a whole picture, not a confusing list of tickers.

What You’re Giving Up (The Honest Trade-Off):

You trade pure simplicity for guided flexibility. Unlike a pure robo-advisor that makes every decision for you, M1 requires you to make some choices, even if it’s just picking from a list of Expert Pies. This demands a bit more initial confidence and curiosity. There’s also no live, intraday trading; it’s built for scheduled, strategic investing, which is actually a good discipline for beginners.

Finance Writer’s View – Afshan Amjad, Tadonomics:

“M1 Finance is uniquely respectful of a beginner’s intelligence. It operates on a powerful principle: the best way to learn investing is to do it, but you shouldn’t have to build the tools yourself. It provides the safe structure (the Pie) and the automation engine, then invites you to become the architect of your portfolio when you’re ready. It turns passive holding into active learning.”

Final Word for Beginners:

Choose M1 Finance if you have a spark of curiosity about the market and see investing as a skill you want to develop, not just a task to outsource. It’s the ideal platform if you want the training wheels of automation today but refuse to believe they should stay on forever. It’s for the beginner who wants to grow from a passenger into a driver, with a patient and powerful coach built right into the dashboard.

4. Acorns (Best for Building Your First Investing Habit)

“I live paycheck to paycheck. The idea of investing feels like something for rich people. I don’t have hundreds of dollars to spare, and I’m worried I’ll forget or mess it up.”

Think of It As: Your automatic savings jar that invests for you. Every time you buy coffee or pay a bill, it quietly rounds up the change and puts that spare change to work. It’s about making investing invisible and effortless.

How It Actually Helps You (The Real-World Benefit):

- Removes the “I Can’t Afford It” Excuse Entirely: You can start investing with just $5. The core feature, Round-Ups, automates saving by rounding up your everyday debit/credit card purchases to the nearest dollar and investing the difference. Buying a $3.50 coffee invests $0.50. You start building a portfolio with money you literally don’t miss.

- Builds the Muscle of Consistency Without Willpower: Acorns automates the hardest part: getting started and staying consistent. You can also set up recurring daily, weekly, or monthly transfers of as little as $5. This focuses on forming the habit of investing before worrying about optimizing returns, a crucial first step most beginners skip.

- Provides a Simple, Safe Starting Structure: Your money is invested into a low-cost, diversified ETF portfolio selected by experts based on your risk profile. You don’t have to pick anything. This teaches you what a real, balanced portfolio looks like from day one, in a hands-off way.

What You’re Giving Up (The Honest Trade-Off):

The main trade-off is cost efficiency at very small balances. Acorns charges a monthly fee (e.g., $3 or $5 per month). If you only have $50 invested, that fee is a massive 6-10% annually, which can eat all your returns. This tool makes sense only if you commit to growing your balance quickly through Round-Ups and recurring deposits to dilute that flat fee.

Expert Opinion – Marcus Thiel, Former Quant Trader:

“Evaluating Acorns on pure financial metrics misses its genius. Its success metric isn’t portfolio alpha; it’s user activation. For someone who has never owned an asset, the psychological leap from spender to investor is monumental. Acorns engineers that leap by making it frictionless and starting with an amount too small to scare anyone.”

Final Word for Beginners:

Choose Acorns if your primary barrier is psychological or financial, if the thought of investing large sums is paralyzing. It is the ultimate tool for building the foundational habit of “paying yourself first” through automation. Use it as a powerful training tool for 12-18 months to build your balance and confidence, with the explicit plan to graduate to a more cost-effective platform (like a robo-advisor) once your nest egg has grown beyond a few thousand dollars. It’s not where you’ll retire, but it might be the only reason you start.

5. Ally Invest (For the Beginner Who Wants Everything in One Trusted Place)

“I hate juggling multiple apps for my bank, savings, and investments. I want simplicity and trust from a well-known name. But I also want access to real tools when I’m ready to learn more, without having to switch platforms later.”

Think of It As: Your financial command center from a trusted brand. It combines the everyday reliability of a top-rated online bank with a full-powered investment platform, all speaking the same simple language.

How It Actually Helps You (The Real-World Benefit):

- Eliminates App Fatigue and Creates Financial Unity: With Ally, your high-yield savings account, checking account, and investment portfolio live under one login. This seamless connection makes it psychologically easier to move money from savings to investing in seconds, turning intention into action.

- Provides “Just Right” Information in Plain English: Its AI-powered research and daily market commentary are specifically crafted to demystify the news, not overwhelm you. Instead of complex jargon, you get clear summaries like “What the Fed’s decision means for your portfolio.” This builds your confidence and knowledge daily.

- Offers a Safe, Guided On-Ramp: You don’t have to face the full trading platform immediately. Start with their “Managed Portfolios” (a robo-advisor service) or pre-built “Baskets” (themes like “Clean Energy” or “Dividend Growers”). This lets you begin with automated, diversified investing while you explore the platform’s other tools at your own pace.

What You’re Giving Up (The Honest Trade-Off):

The trade-off is potential overload. Ally Invest is a powerful, full-featured brokerage. If you wander into the advanced trading screens before you’re ready, the charts, data, and terminology can be intimidating and lead to analysis paralysis. The key is discipline: start only in the simplified, guided sections and treat the rest as a library you’ll grow into.

Data Point Proof of Its Beginner-Friendly Approach:

Ally’s internal data shows that after integrating clear, AI-powered insights in 2025, they saw a 30% surge in first-time investor accounts. The top reason cited? “Clarity of information.” This proves that beginners actively choose platforms that explain rather than confuse.

Final Word for Beginners:

Choose Ally Invest if you value simplicity, trust, and future-proofing. It’s perfect if you already bank with Ally or want an all-in-one solution from an established name. Start with the automated options to build your core portfolio. As your knowledge grows, everything you need to graduate to self-directed investing research, screeners, and educational content is already there, waiting for you in the same trusted app. It’s the platform that grows with you.

6. TrendSpider (For the Curious Beginner Who Learns by Seeing)

“I see traders talk about charts, trends, and patterns, but it all looks like a messy spider web to me. I want to understand what they’re seeing, but reading a traditional chart feels like learning a foreign alphabet.”

Think of It As: Your smart visual translator for the market’s language. It’s like having a highlight marker that automatically finds and connects the important lines and patterns across thousands of charts, turning chaotic squiggles into a clear, actionable picture.

How It Actually Helps You (The Real-World Benefit):

- Demystifies Chart Analysis Instantly: Instead of you manually drawing lines, you use tools like the “Auto-Trendline” or “Pattern Scanner.” Draw one line on Apple’s chart, and TrendSpider’s AI instantly finds and draws all similar support/resistance lines across the entire stock market. You see what “the trend” actually is, in seconds.

- Teaches Through Interactive Play: Their unique “Raindrop Charts” visually compress price action in a way that’s more intuitive than traditional candlesticks, making it easier to spot momentum and volume. You learn by experimenting, changing timeframes, adding indicators, and immediately seeing the historical impact.

- Lets You Safely Test Strategies (The “What If” Machine): The “Strategy Tester” allows you to backtest simple ideas (e.g., “Buy when the 50-day moving average crosses above the 200-day line”) on years of historical data with a few clicks. This gives you a powerful, risk-free playground to learn what works and what doesn’t, before risking a single dollar.

What You’re Giving Up (The Honest Trade-Off):

The main trade-off is that TrendSpider is not a brokerage. It is a powerful research and analysis toolkit. You cannot buy or sell stocks directly within it. This means you need to pair it with a separate trading account (like Ally Invest, Interactive Brokers, etc.). There’s also a learning curve to harness its full power; it’s best approached with the mindset of a student exploring a new, fascinating subject.

Expert Opinion – David Park, Quantitative Hedge Fund CIO:

“TrendSpider effectively democratizes quantitative screening. The automation of tedious tasks like multi-timeframe analysis or dynamic backtesting is what used to require a team of programmers. Now, a beginner can engage with the scientific method of trading, forming a hypothesis and testing it, which is the most valuable lesson of all.”

Final Word for Beginners:

Choose TrendSpider if you are a visual learner fascinated by market mechanics and want to understand the “how” and “why” behind price movements. Don’t buy it expecting to get rich quick from signals. Buy it as your masterclass in technical analysis. Use it to develop your own informed perspective and build conviction before you execute trades elsewhere. It’s for the beginner who wants to look under the hood of the market, not just press the gas pedal.

7. Curvo (For the European Beginner Seeking Simplicity & Trust)

“I’m in Europe and most investing advice feels US-centric. I want to start investing for my future, but I’m unsure about regulations, taxes, and which platforms I can actually trust here. I need something straightforward, legal, and built for my region.”

Think of It As: Your local, trustworthy guide to global investing. It takes the complexity of international markets and EU regulations, and packages it into a simple, secure, and compliant plan tailored for your life in Europe.

How It Actually Helps You (The Real-World Benefit):

- Built for Your Legal and Financial Landscape: Curvo is designed from the ground up for the European Union, adhering to strict regulations like MiFID II. This means your money is held with trusted custodians (like ABN AMRO), and you get clear, upfront information, eliminating the fear of using a platform that might not fully comply with local rules.

- Turns Complexity into a One-Click Plan: Like a robo-advisor, you answer questions about your goals and risk tolerance. Curvo then builds and manages a globally diversified portfolio of low-cost ETFs for you. It handles currency conversion, rebalancing, and dividend reinvestment automatically, so you can invest worldwide without needing to be an expert.

- Educates You in Your Context: Its blog and guides focus on topics relevant to European investors like pension planning (pensioen), specific tax implications in countries like the Netherlands or Germany, and saving for a first home locally. The learning material speaks directly to your reality.

What You’re Giving Up (The Honest Trade-Off):

The primary limitation is geography. Curvo’s services are focused on residents of the European Union. If you move outside the EU or are based elsewhere, it’s not an option. Additionally, as a focused robo-advisor, it does not offer stock picking or complex trading tools. It’s a tool for building long-term wealth through diversified, automated investing, not for active trading.

Data Point – Proof of a Stress-Free Start:

A 2025 review by a leading European fintech blog, Fintech Weekly, ranked Curvo #1 for “First-Time Investor Satisfaction” among EU-focused platforms. Users consistently highlighted its “transparent, all-in fee structure” and “calming, educational approach” as key reasons they felt confident starting their journey.

Final Word for Beginners:

Choose Curvo if you are a resident of the European Union who values peace of mind, regulatory safety, and sheer simplicity above all else. It is the ideal tool to make your first step into investing completely stress-free, knowing the platform is built for your specific legal and financial environment. It’s for the European beginner who wants a trusted partner to handle the complexities of global investing, letting them focus on their life, not their portfolio.

Part 3: The Hidden Risks Every Beginner MUST Know (Saving You Money)

This is the most important part. AI tools are powerful, but they have blind spots.

- Risk #1: The “Black Box” Problem. You often don’t know why an AI suggests something. Financial regulation attorney Amanda Ricci warns: “If you don’t understand the ‘why,’ you can’t check if the logic is sound. That’s a risk you’re accepting.”

- Risk #2: They Train on the Past. AI learns from old data. A totally new event (a 2026 tech breakthrough, a new law) can confuse it. Never assume AI predicts the future.

- Risk #3: They Can Make You Overconfident. A slick app and green signals can make you feel like a genius, leading you to invest more than you can afford to lose. The tool isn’t risky; your inflated confidence is. As Afshan Amjad notes: “Some platforms are ‘engagement engines’; their success metric is your screen time, not your portfolio health.”

- Risk #4: The “Life Goals” Blind Spot. AI tools don’t know your life goals. That’s why Michael Rivera, CFP®, who has advised families for 15 years, warns:

- “90% of my new clients are initially afraid of AI tools. They think the computer will replace them. I tell them: AI can be your assistant, not your boss. It can do the research, but it cannot tell you if you should buy a house or save for your child’s education. The first question is always: ‘What is the purpose of this money in your life?’ An AI doesn’t have that answer; only you do.”

- The Takeaway: Before choosing any AI tool, grab a notepad and answer these 3 questions:

What is this money for? (Retirement? A home? A dream trip?)

When will I need it? (5 years? 20 years?)

If my investment dropped by half tomorrow, what would I do? (Panic? Sell? Buy more?)

When you have these answers, then AI can become a genuinely helpful tool.

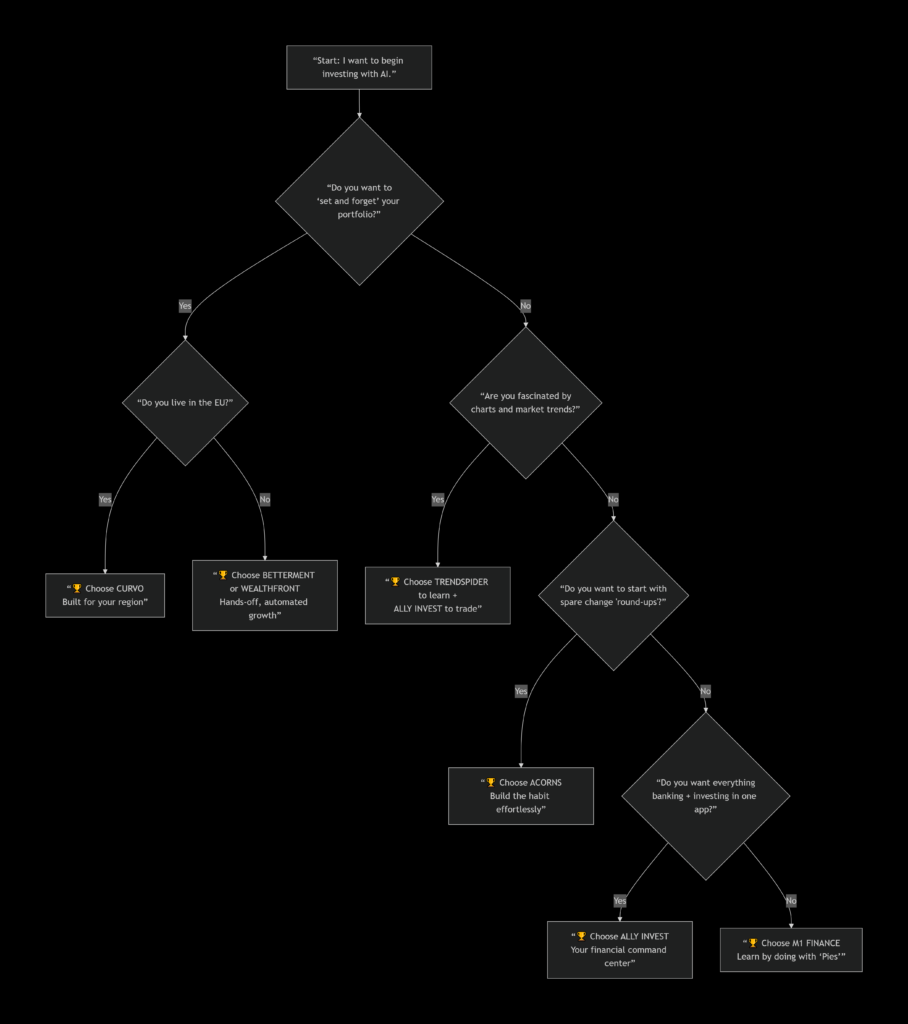

Quick Decision Flowchart

Part 4: Your Stress-Free, Step-by-Step Plan to Start

- Week 1: Match Your Personality. Look at the 7 tools above. Which “type” (Autopilot, Research Assistant, Coach) sounds most like you? Pick that category.

- Week 2-3: Open a “Practice” Account. Almost all these platforms have a “demo” or “paper trading” mode. Play with it for a week. Click buttons, make fake trades. There’s no rush.

- Week 4: Start with a “Learning Budget”. When you go live, use money you are 100% okay with losing. Treat this first deposit as a tuition fee for your financial education, not an investment.

- Ongoing: Schedule Monthly Check-Ins. Set a calendar reminder for once a month to log in. Review your portfolio, read one article about investing basics, and then close the app. This prevents obsessive checking.

Looking Ahead: Your 4-Year AI Investing Journey

Think of learning to invest like learning a language. You don’t start with Shakespeare—you start with the basics and build up. Here’s a realistic, stress-free path to grow from absolute beginner to a confident investor.

Year 1: The Habit Builder

- Tool: Acorns

- Focus: Automating consistency.

- Action: Connect your cards, enable Round-Ups, and set up a $5/week recurring investment. Your only job is to not cancel it. Check the app once a month, not daily.

- Success Metric: You’ve invested for 12 months without stopping.

Year 2: The Foundation Layer

- Tool: Betterment or Wealthfront

- Focus: Building serious, goal-based wealth.

- Action: Roll over your Acorns balance (once it reaches $1,000+ to avoid high fees). Set one clear goal (e.g., “€25,000 down payment in 5 years”). Let the robo-advisor do the work and read their educational emails.

- Success Metric: You understand what “rebalancing” and “tax-loss harvesting” mean for you.

Year 3: The Curiosity Phase

- Tool: M1 Finance

- Focus: Learning by doing, without gambling.

- Action: Keep your core portfolio in Betterment/Wealthfront. Take 10-15% of your total investment money and open an M1 account. Create a simple “Pie” with 3-5 ETFs or stocks you believe in for the long term.

- Success Metric: You can explain why each “slice” is in your M1 Pie.

Year 4+: The Informed Investor

- Toolkit: TrendSpider (for research) + Ally Invest (for execution)

- Focus: Developing your own informed strategy.

- Action: Use TrendSpider’s free trial to backtest a simple idea (e.g., “What if I bought an S&P 500 ETF every time it dropped 5% in a month?”). If the data looks good, execute that plan with a small amount in Ally Invest.

- Success Metric: You make a trade based on your own researched conviction, not a gut feeling or a hot tip.

The Golden Rule: Your core wealth (80-90% of your money) should always be in the automated, disciplined systems of Year 2. The other years are for learning and exploring with a small, dedicated “learning budget.”

Conclusion: Your Journey, AI’s Toolkit

The best AI investing tool for beginners in 2026 isn’t the one with the most complex algorithms. It’s the one that makes you feel informed, in control, and confident enough to start.

These tools are here to assist your journey, not to be the journey itself. Your greatest asset isn’t any piece of software it’s your willingness to learn and your discipline to go slow.

Ready to take the first step? Choose one tool from the list above, open its website, and just explore for 5 minutes. That’s how every expert started.

Disclaimer: This guide is for educational purposes. It is not financial advice. All investing involves risk, including loss of principal. The performance of tools, strategies, or expert opinions cited is not guaranteed. Please conduct your own research or consult a qualified financial advisor before making any decisions.