The stock market in 2026 is expected to remain highly dynamic and uncertain, creating both opportunities and risks for investors worldwide. Rather than focusing on exact market predictions, this guide is designed to help investors understand stock market 2026 risks and build practical investment strategies that work in uncertain conditions.

Whether you are a beginner starting your investment journey or an experienced investor refining your portfolio, understanding market behavior, valuation risks, and volatility management is essential. This comprehensive Tadonomics guide combines insights from expert research, financial institutions like investopedia , YouTube market analysis, and my own hands on trading experience to help you navigate the global stock market 2026 outlook with clarity and confidence.

What You’ll Learn in This Guide

- Why financial experts remain cautious about 2026

- Key trends across stocks, bonds, and crypto markets

- Market volatility and realistic risk scenarios

- Investment strategies for beginners and intermediate investors

- Survey insights with logical explanations

- FAQs for quick and practical answers

Why Experts Are Cautious About the Stock Market 2026

As 2026 approaches, a growing number of global financial experts are advising investors to remain cautious rather than overly optimistic. Analysts from Investopedia, Interactive Brokers, CFA Institute, Bloomberg, and Morningstar broadly agree that the market is currently positioned at a sensitive and uncertain crossroads.

Despite continued innovation particularly in artificial intelligence and technology driven sectors experts warn that optimism alone is not enough to justify current market conditions. Several structural and macroeconomic risks are simultaneously present, making the 2026 stock market outlook more complex than in previous years.

High Valuations Across Key Sectors

One of the most consistent warnings from financial experts relates to elevated stock valuations, especially in AI and technology stocks. According to multiple Investopedia and Morningstar analyses, many leading growth companies are trading at price to earnings ratios that assume years of uninterrupted growth.

CFA Institute research highlights that when valuations move significantly ahead of earnings fundamentals, markets become more vulnerable to corrections even without major economic shocks. This valuation imbalance increases downside risk for investors entering at current levels.

Market Volatility Index (2020–2026)

Interest Rate Uncertainty & Monetary Policy Risk

Another major concern shared by economists and institutional analysts is interest rate uncertainty. While markets continue to speculate about future rate cuts, experts from Interactive Brokers and Bloomberg emphasize that inflation control remains a priority for central banks.

Even minor shifts in Federal Reserve policy can:

- Reprice growth stocks

- Increase bond yield volatility

- Reduce investor risk appetite

Experts warn that markets are highly sensitive to expectations, not just actual policy decisions.

Political & Geopolitical Risk Factors

Political uncertainty is also a recurring theme in expert outlooks for the stock market 2026. Election cycles in major economies, ongoing geopolitical tensions, and global trade policy risks contribute to unstable stock market 2026 sentiment.

According to global risk assessments cited by financial institutions, the stock market 2026 tends to underprice political risk until it materializes, often resulting in sudden volatility spikes and sector specific sell offs.

What Surveys & Institutional Reports Reveal

Survey based insights further reinforce expert caution:

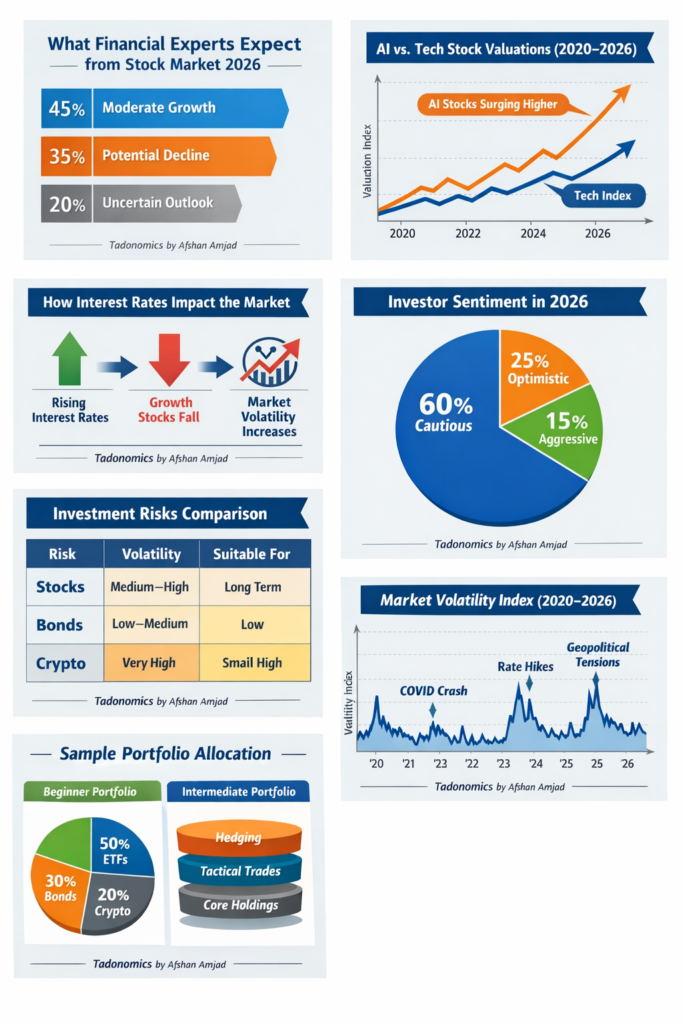

- CFA Institute Market Sentiment Survey (2025):

- 45% of professionals expect moderate growth

- 35% foresee potential market decline

- 20% remain uncertain due to macroeconomic risks

- Interactive Brokers Investor Survey:

- 60% of investors report a defensive or cautious stance

- 25% remain selectively optimistic

- Only 15% are positioning aggressively

These findings highlight a lack of strong consensus an important signal that risk management should take priority over aggressive positioning.

Afshan Amjad’s Tadonomics Expert Perspective

When multiple expert institutions are cautious at the same time, it’s not a signal to panic it’s a signal to prepare. Markets don’t reward blind optimism; they reward structured thinking, diversification, and emotional discipline.”

From a Tadonomics standpoint, expert caution around the stock market 2026 does not suggest avoiding the market altogether. Instead, it emphasizes the importance of understanding risk, adjusting expectations, and building flexible investment strategies for navigating stock market 2026 conditions effectively.

The key takeaway for investors is clear:

- Caution is not fear

- Preparation is not pessimism

- And discipline matters more than predictions

Investors who recognize these signals early are better positioned to navigate volatility and identify opportunities when market conditions shift.

Valuation Risk and the AI Stock Hype Cycle

AI & Tech Stocks Are Trading at Elevated Valuations

Artificial intelligence has become one of the most powerful and influential investment themes of the decade. From automation and data analytics to generative AI applications, the technology promises long-term transformation across industries. However, many AI and technology companies are currently trading at historically high price to earnings (P/E) ratios, reflecting growth expectations that may take several years to fully materialize. Investors in stock market 2026 should be mindful of these elevated valuations when allocating capital to AI and tech sectors.

According to market analysts, current valuations often assume near perfect execution, rapid adoption, and sustained revenue growth. While some companies may meet these expectations, history shows that markets tend to price innovation ahead of reality during early expansion phases, a pattern likely to influence stock market 2026 trends.

Experts frequently compare today’s AI enthusiasm with past hype cycles, such as the dot com boom, where technology ultimately reshaped the economy but many investors who entered at inflated prices faced steep losses during market corrections.

Sensitivity of Markets in Stock Market 2026

When stock valuations move significantly ahead of underlying company fundamentals, markets become increasingly sensitive to even minor negative developments. In stock market 2026, optimism leaves very little margin for error. As a result, any disappointment no matter how small can trigger sharp market reactions. Analysts warn that several overlapping factors in 2026 could increase the probability of sudden market corrections.

Profit Taking Behavior and Its Impact

One major trigger is profit-taking behavior. Many early investors in AI and high growth technology stocks have already seen substantial gains. As valuations rise further, even positive earnings may not prevent selling pressure as investors lock in profits, putting downward pressure on prices in the stock market 2026 scenario.

Earnings Growth Risk in High Valuation Stocks

Another concern is earnings growth risk. High valuation stocks often require consistently strong earnings to justify their prices. If revenue growth slows, margins compress, or guidance weakens even slightly, markets may react aggressively, particularly in sectors priced for perfection during stock market 2026.

Regulatory Scrutiny Adds Uncertainty

Regulatory scrutiny also adds uncertainty. As AI adoption expands, governments and regulators are paying closer attention to data privacy, market dominance, and ethical AI usage. New regulations or compliance requirements could increase costs or limit growth potential for major technology platforms, influencing investor sentiment in stock market 2026.

Interest Rate Dynamics and Market Sensitivity

In addition, interest rate dynamics remain a critical risk factor. Rising or prolonged higher interest rates increase the discount rate applied to future earnings, which disproportionately impacts growth and AI stocks. Even expectations of tighter monetary conditions can trigger valuation resets before any policy change actually occurs, affecting the stock market 2026 landscape.

Navigating Volatility with Discipline

In such conditions, market sentiment can shift rapidly from optimism to caution or fear, leading to fast and sometimes exaggerated price declines, particularly in overvalued sectors. It is important to note that this does not mean artificial intelligence will fail or lose its long term relevance. AI remains transformative, but stock market 2026 requires disciplined investing: timing, position sizing, diversification, and risk management become crucial.

Balancing Optimism with Patience

Investors who balance optimism with structure and patience rather than chasing momentum are far better positioned to navigate corrections and remain invested through market volatility in 2026 without being forced out during corrections. In stock market 2026, timing matters more than predictions.

Beginner Guidance! How to Reduce Stock Market Risk in 2026

For new investors, experts consistently recommend a defensive and diversified approach:

- Avoid overexposure to a single AI or tech stock

- Diversify across sectors and asset classes

- Prefer ETFs or index funds to reduce single stock risk

Visual Placeholder:

AI vs Tech Stock Valuations (2020 to 2026)

This chart helps investors understand how AI valuations have outpaced broader technology benchmarks.

Interest Rates & Political Factors Shaping Stock Market 2026

Interest rates and political developments remain two of the most powerful forces shaping global financial markets. In stock market 2026, their combined influence is expected to play a critical role in determining market direction, volatility levels, and investor behavior. Understanding how these factors interact helps investors make more rational and risk-aware decisions while navigating the uncertainties of stock market 2026.

How Interest Rates Impact Stocks and Bonds

Interest rates act as the foundation of market pricing. Any shift in Federal Reserve monetary policy directly affects how assets are valued across the financial system.

Changes in interest rates influence:

- Stock valuations: Higher interest rates reduce the present value of future earnings, placing pressure on growth-oriented stocks particularly AI and technology companies.

- Bond yields: Rising rates generally push bond prices lower while increasing yields, affecting income-focused portfolios.

- Currency movements: Higher rates often strengthen the U.S. dollar, impacting global markets and multinational companies.

- Investor risk appetite: When rates rise, investors tend to shift from riskier assets to safer income generating instruments.

Even expectations of rate changes rather than actual policy moves can cause sharp market reactions. In 2026, analysts caution that prolonged higher rates or delayed rate cuts could continue to challenge equity markets, especially high valuation sectors.

Investor Guidance:

- Growth-focused investors should monitor rate expectations closely

- Income investors may find opportunities in bonds during periods of yield expansion

- Diversification across rate sensitive and defensive assets helps reduce risk

Elections and Geopolitical Uncertainty

Political uncertainty adds another critical layer of complexity to the 2026 market outlook. Elections in major economies, ongoing geopolitical tensions, and shifts in global trade policies can significantly influence investor confidence and capital flows.

Key political risks include:

- Election cycles: Policy changes related to taxation, regulation, and government spending can impact specific industries.

- Geopolitical tensions: Conflicts, sanctions, or diplomatic breakdowns often lead to risk-off behavior and capital flight.

- Trade disputes: Tariffs and supply chain disruptions can hurt global growth and corporate earnings.

These developments can result in:

- Sudden market sell-offs

- Spikes in volatility across global indices

- Sector specific risks in energy, defense, infrastructure, and technology

Markets generally dislike uncertainty more than bad news. In 2026, multiple overlapping political events may amplify volatility, making short-term market moves harder to predict.

Investor Guidance:

- Avoid making impulsive decisions based on political headlines

- Focus on long term fundamentals rather than short term noise

- Maintain exposure across regions and sectors to reduce concentration risk

Tadonomics Insight ! Afshan Amjad

“Interest rates and politics are forces investors cannot control but how they respond to them is fully within their control. Strategy, patience, and diversification matter far more than reacting to every policy headline.” {Afshan Amjad}

From a Tadonomics perspective, successful investing in 2026 requires separating signal from noise. Investors who understand macroeconomic drivers and avoid emotional reactions are better positioned to protect capital and identify opportunities during periods of uncertainty.

Survey Insights from Financial Institutions

CFA Institute Market Expectations (2025–2026)

- 45% expect moderate market growth

- 35% anticipate potential market decline

- 20% remain uncertain

This lack of consensus signals why disciplined investment strategies are essential.

Interactive Brokers Investor Sentiment

- 60% cautious and defensive

- 25% optimistic

- 15% aggressive

Despite rising indices, investor confidence remains mixed.

Afshan Amjad’s Perspective:

“Forecasts may change and headlines may create fear, but patience, discipline, and diversification never go out of style.”

According to Tadonomics principles, long-term success in 2026 will come from controlling emotions and following a structured investment plan not chasing predictions.

Trends Across Stocks, Bonds, and Crypto in 2026

| Asset Class | Risk | Volatility | Suitable For |

|---|---|---|---|

| Stocks | Medium to High | High | Long term |

| Bonds | Low to Medium | Low | Stability |

| Crypto | Very High | Very High | Small allocation |

Stock Market Trends

- U.S. stocks: moderate growth expected

- AI & tech: high potential, high risk

- Beginners: avoid heavy single stock exposure

Visual Placeholder: Top AI & Tech Stocks Outlook 2026

Bonds & Safer Investments

- Sensitive to interest rate changes

- Provide portfolio stability

- Help hedge against volatility

Crypto Market Outlook

- High volatility expected

- Beginners should invest small amounts

- Diversification and stablecoins reduce risk

Market Volatility & Risk Scenarios

Key Risks to Watch

- Stock corrections due to high valuations

- Economic slowdown or geopolitical shocks

- Interest rate hikes reducing returns

Understanding Volatility

- Daily market swings are normal

- Emotional reactions cause losses

- Volatility can create long-term opportunities

Visual Placeholder: Market Volatility Index 2020–2026

Practical Investment Strategies for 2026

Investing in 2026 requires a structured, disciplined approach, especially given market volatility, high valuations in AI/tech, and potential macroeconomic uncertainty. Below are practical strategies to help investors minimize risk and maximize long-term returns.

1. Portfolio Diversification

Diversification is one of the most effective ways to manage risk. By spreading investments across multiple asset classes, you reduce exposure to any single market shock.

How to diversify effectively:

- Across asset classes: Include stocks, bonds, and cryptocurrencies to balance growth and stability.

- Across sectors: Avoid concentrating solely on one industry. For example, combine tech, healthcare, energy, consumer goods, and finance.

- Geographical diversification: Invest in both domestic and international markets to hedge against country-specific risks.

- Different instruments: Use ETFs, index funds, or mutual funds to access diversified portfolios without picking individual stocks.

Tadonomics Tip: Even within a single sector, select companies with varied business models to reduce correlation risk.

2. Safer Investment Approaches

Adopting a long term mindset is critical in 2026. Markets may fluctuate daily, but long-term strategies reward discipline.

Key techniques:

- Dollar Cost Averaging (DCA): Invest a fixed amount regularly to reduce the impact of short-term volatility.

- Avoid hype driven decisions: Resist chasing “hot” AI or crypto trends based solely on media buzz.

- Focus on fundamentals: Choose assets with strong earnings, solid management, and clear growth potential.

- Set realistic goals: Identify short-term and long-term objectives and allocate assets accordingly.

Tadonomics Insight: Patience is as important as research. Emotional reactions often lead to losses in highly volatile markets.

3. Common Mistakes to Avoid

Investors frequently make errors that reduce returns or increase risk. Being aware of them can protect your capital.

- Over-leveraging: Avoid excessive use of borrowed funds, which magnifies losses during market corrections.

- Emotional trading: Reacting to daily market swings often results in buying high and selling low.

- Ignoring risk signals: Stay alert to macroeconomic trends, interest rate changes, and valuation warnings.

- Lack of rebalancing: Portfolios should be reviewed and adjusted regularly to maintain target allocations.

- Concentration risk: Over-investing in a single stock, sector, or crypto can lead to catastrophic losses during downturns.

Tadonomics Tip: Keep a risk checklist and periodically review all holdings. A disciplined review process is often the difference between a stable portfolio and one prone to large drawdowns.

4. Practical Examples for Beginners

- Allocate 50% in diversified stock ETFs, 30% in bonds, and 20% in crypto or alternative assets.

- Rebalance every 6 –12 months to maintain your target asset allocation.

- Use stop-loss orders or set investment thresholds to protect from extreme volatility.

5. Practical Examples for Intermediate Investors

- Combine long-term positions with short term tactical trades in high-potential sectors like AI or green energy.

- Use hedging strategies such as options or inverse ETFs to protect against market corrections.

- Monitor macro indicators (interest rates, CPI, geopolitical events) to make informed allocation shifts.

💡 Key Takeaway:

In 2026, success depends less on predicting market tops and bottoms, and more on discipline, diversification, risk management, and long-term planning. By following structured strategies and avoiding common mistakes, investors can reduce risk while positioning for growth in uncertain markets.

Advanced Tadonomics Insight for Experienced Investors

For seasoned investors, 2026 requires a strategic approach that balances growth opportunities with risk management. Key principles include:

1. Use Hedging Strategies

Hedging can protect portfolios from downside risk without limiting upside potential. Consider options, inverse ETFs, or sector-specific hedges during periods of high volatility. Hedging is especially important for concentrated positions in AI, tech, or high growth sectors.

2. Focus on Capital Preservation

Protecting your core capital should take priority over chasing aggressive returns. Allocate a portion of your portfolio to defensive assets like bonds, dividend paying stocks, or cash equivalents to reduce exposure to sharp market swings.

3. Maintain Liquidity for Opportunities

Keeping sufficient cash or liquid assets allows you to act when attractive opportunities arise, such as market dips or undervalued sectors. Liquidity also provides flexibility to rebalance portfolios without forcing sales at a loss.

4. Control Emotions During Market Stress

Even experienced investors can make costly mistakes if they react emotionally. Discipline, patience, and sticking to a pre defined investment plan are crucial for long term success. Avoid panic selling and maintain a clear strategy for both gains and corrections.

Tadonomics Key Insight:

“In 2026, expertise isn’t just about picking winners it’s about managing risk, staying disciplined, and seizing opportunities with a calm and calculated approach.”

Final Thoughts & Next Steps

The stock market in 2026 is expected to remain dynamic and unpredictable. While uncertainty can be intimidating, disciplined, risk-aware investing combined with Tadonomics principles allows investors to transform potential challenges into long-term opportunities. Understanding market structure, macroeconomic influences, and behavioral patterns is key to navigating volatility successfully.

Key Takeaways

- High valuations & AI hype increase risk: Growth stocks, especially in AI and technology, are trading at elevated levels. Proper entry timing and risk management are critical.

- Bonds & crypto improve diversification: Including defensive assets like bonds and stablecoins can balance high risk equity positions and reduce portfolio volatility.

- Emotional control matters more than predictions: Markets may fluctuate, but rational decision-making, patience, and discipline outperform attempts to time the market.

Practical Next Steps for Investors

- Review and rebalance your portfolio regularly: Ensure your allocation aligns with your risk tolerance and investment goals. Adjust for over-concentration in any sector or asset class.

- Keep learning about market behavior: Follow credible sources, monitor macroeconomic indicators, and understand how interest rates, inflation, and geopolitical events impact different markets.

- Follow Tadonomics for logic driven insights: Focus on structured strategies, risk management, and disciplined investing rather than hype-driven decisions.

- Plan for both opportunities and risks: Keep sufficient liquidity to capitalize on market dips and maintain hedges to protect against sudden downturns.

Final Afshan Amjad Tadonomics Insight

“With structured planning, diversification, and emotional discipline, investors at every level can convert 2026 uncertainty into actionable opportunities. The market’s unpredictability is not a threat it is a landscape for strategic growth.”

By combining long term planning, diversified portfolios, and behavioral discipline, investors can position themselves to benefit from both growth opportunities and safe havens during periods of volatility in 2026.

FAQS

Q1: Is 2026 a good year to invest in the stock market?

A1: 2026 can be a good year to invest if you focus on diversification, discipline, risk awareness, and long‑term strategy rather than trying to time the market. Many analysts expect selective opportunities, especially where valuations are reasonable and earnings growth is solid.

Q2: Should beginners invest in stocks in 2026?

A2: Beginners can invest safely by using diversified tools like index funds or ETFs, putting small amounts in high‑growth themes, and avoiding overconcentration in single stocks. Having a long‑term mindset helps navigate short‑term volatility.

Q3: Are AI stocks still worth buying in 2026?

A3: AI stocks may still offer growth, but they carry high risk due to valuations and competition. Investing in a mix of AI leaders and diversified tech ETFs with proper risk controls is safer than heavily concentrated bets.

Q4: How can I protect my portfolio from volatility in 2026?

A4: To handle volatility, avoid emotional trading, rebalance regularly, diversify across asset classes (stocks, bonds, crypto), and use strategies like dollar‑cost averaging. Defensive assets and international diversification also help during turbulent periods.

Q5: How should I allocate between bonds, stocks, and crypto?

A5: A balanced allocation might include core equity exposure, moderate bond positions for stability, and a small portion in crypto or alternative assets for growth. The exact mix depends on your risk appetite and investment horizon.

Q6: What sectors could outperform or underperform in 2026?

A6: Sectors tied to AI infrastructure, semiconductors, healthcare, and global tech adoption may perform well, while overvalued growth stocks could face corrections. Regions outside the U.S., like Asia and Europe, may offer diversification benefits with less concentrated tech risk.

Q7: Should I follow market forecasts and predictions for 2026?

A7: Forecasts (like S&P 500 targets or growth projections) are useful for context, but they should not drive investment decisions on their own. Combining logical analysis with personal strategy is more reliable than chasing predictions.

Q8: What role do interest rates play in 2026 investing?

A8: Interest rates influence valuation, bond yields, and investor sentiment. Higher rates generally reduce the attractiveness of growth stocks, making rate expectations an important part of your strategy.

Q9: How can I avoid common investing mistakes in 2026?

A9: Avoid over‑leveraging, emotional trading, ignoring risk signals, overconcentrating in one asset class, and chasing short‑term trends. A calm, disciplined plan based on diversification and risk management works best.

Q10: What is the best Tadonomics investing principle for 2026?

A10: The best Tadonomics strategy combines diversification, emotional discipline, structured planning, and continuous learning. Focus on long term goals rather than short term market noise. “Predictions change, headlines exaggerate but discipline and diversification are timeless.”